Advantages of Becoming a Fiduciary

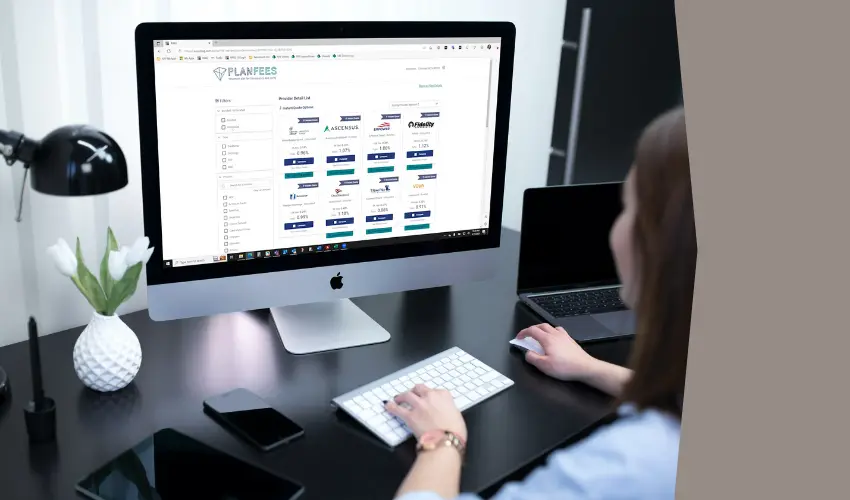

Acting in a fiduciary role can help you elevate your retirement plan practice and provide higher touch service to sponsors. Understanding the different types of fiduciaries, advantages of becoming one and tools available to address fiduciary responsibilities is key for advisors looking to expand their services — and grow their book.